One of the things we have discussed over the last few months is the concept of value. The question ‘what is value’ is such a philosophical question. It is often assumed that economists believe price to be equal to value, but if that was so, why would we have the concept of willingness to pay?

Willingness to pay lies at the basis of the demand curve. You can think of it in this way: it is not price that drives demand, but demand that drives price. That is why the quantity is on the x-axis and price is on the y-axis, in accordance with the mathematical custom to put the dependent variable on the y-axis – the price.

It is constructed from individuals’ willingness to pay often found through a survey of sorts. The questionnaire would be made up of one variation to a theme: How much would you be willing to pay for one of this or that product, how much for two of these products? etcetera. The idea is based on the law of diminishing marginal utility – people would in general value an extra item of a thing less than the ones before.

Although the law of diminishing marginal utility assumes rational thinking, it does allow for a subjective valuation of something. How much is, for example, a shirt worth to me?

The difference between the price that would result from the market mechanism and all the individuals’ willingness to pay adds up to the consumer surplus. The consumer surplus represents the share of welfare that falls to consumers in a particular market. Consumers who were willing to pay more than the market price, value this product more than the price they have to pay. But it veils the cost that has not been included in the price: for example underpaid workers, bad labour conditions, damage to ecosystems, pollution of living conditions. The question that rises then is: Is price a good indicator of the true cost?

Because of the above, I like to make the distinction between ‘value’ and ‘cost’. Value is a subjective concept, as is willingness to pay. Willingness to pay is monetized and it includes practical considerations like income level. The definition of cost I want to employ here is the entirety of both private costs and external costs, together known as social costs. Price is in general an indicator of private costs, since these are the cost internal to the suppliers total costs function, and externalities that have been internalized.

I once heard someone say: “The happiest moment of the day is when I relieve myself on the toilet.”, which makes it clear that some things of value cannot be bought – or monetized. So, when we explore the concept of value, it is this we explore.

Willingness to pay in itself is a snapshot of the moment I stated my willingness. The moment I lifted my ‘I raise’-sign at an auction. When stated publicly like in an auction setting, there are often many psychological and social aspects at play. Your want increases, you do not want to be a miser, you want to ‘win’. When thinking about it sitting in an easy chair, you might take more rational thoughts into consideration. Thus, value is made up of many things: how much status do you expect to derive from your intended purchase? How much will it improve a burdensome task? How much comfort will it give you? What will its lifespan be? Is it easy to maintain and repair? What will we not get from it, that we crave?

And then there is price. When I buy something, I would like to be able to trust my supplier. I want to trust that she pays her workers at least a decent living wage, and that the environment has not been damaged in the process of production. I think that when I buy something at an absurdly low price, this is likely not the case. Quality often suffers, although it is often more that suffers. I am not paid to write this and I hope your assessment is that I am highly underpaid – not that quality suffered.

A high price, on the other hand, does not give me any indication of the practices down the supply chain. Do I pay a premium for the brand, or the designer? Does a company attest its sustainability goals on its website, but is it all window-dressing? It is often difficult for me to know, but to my defense: companies often do not know what is happening further down the supply chain either. Price is not a proper conveyor of true cost.

Production, or gross domestic product, is measured in volume against market prices. Thus, what is not conveyed in prices, is by definition not conveyed in GDP. Which makes it the poorest measure of our welfare, among other reasons.

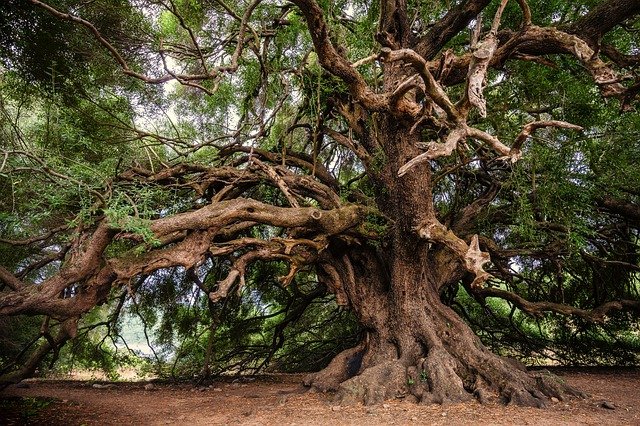

There is a value-related question I did not address. This is not so much a question of what value is, but of how we value something. How do we value the labour that has been spent on the shirt we buy? The work of the tailor, the designer, the marketeer, the sales person? How much do we value the soil used to plant the cotton? The iron ore used in the machinery used to produce the shirt? The ecosystem it is mined from? The capital made available by a shareholder, bank, the owner or the public – through crowd-funding? Does the price we pay for a product agree with our valuation of its production factors, and the distribution across production factors? If we expect at least a living wage, do we hold the producers of the products we buy to the same standards? If we value the nature that we find at our doorstep or a holiday trip away, do we also value nature out of sight and out of reach?

The invisibility and anonymity of production factors make it easy for us to accept market prices. But if we were aware of the true cost, would our willingness to pay be more in line with these?

henny@21steconomics.org – You can also find me on LinkedIn