Mental Models

One of the aspects I find crucial regarding a 21st-century economics education is systems thinking. However, when discussing systems thinking with interested parties, I often encounter the challenge of its vastness. According to the Waters Center for Systems Thinking, it comprises fourteen habits and seven visual tools, which is quite extensive. Additionally, we can differentiate between ‘soft’ systems thinking, which does not involve modeling, and ‘hard’ systems thinking, involving modeling and simulating models. With so much to consider, the question arises: where should one begin?

Nevertheless, I believe that the starting point is not of utmost importance. The Waters Center habits cards refer to the visual tools, and the visual tools relate to systems thinking habits. Therefore, it seems like a chicken-and-egg discussion. Consequently, I prefer to choose a specific tool or skill and reflect on how it can be applied in economics education. Today, my choice is the ladder of inference, which I intend to apply the ladder to the market.

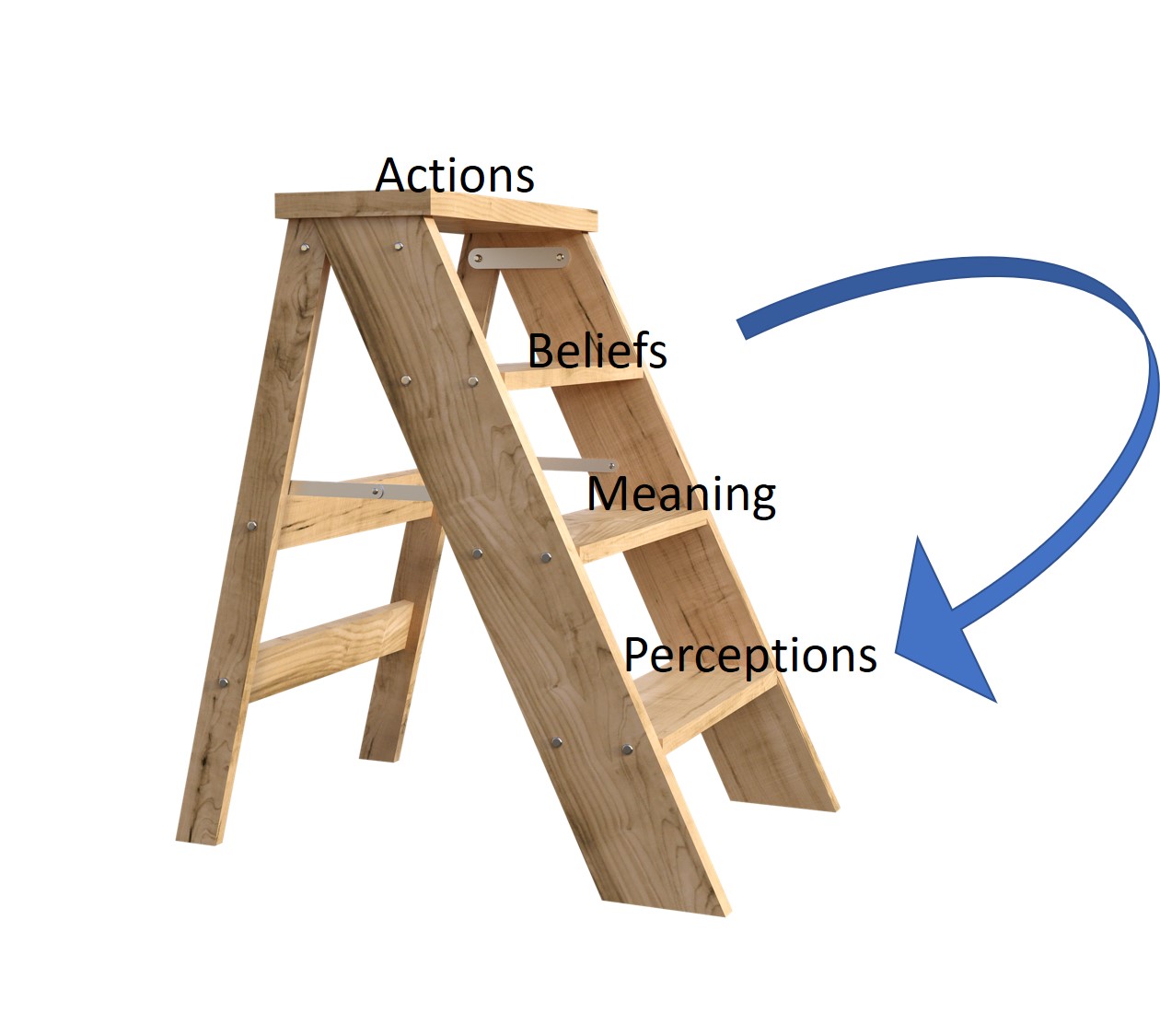

The ladder of inference is a visual tool that demonstrates how perceptions, or mental models, lead to beliefs, which, in turn, result in actions that are reinforced over time. While some of these actions may not be revolutionary, even everyday decisions, such as purchasing a product, become ingrained through repetition.

Although these decisions happen on an individual level, collectively, they shape market demand. Thus, when societal outcomes do not align with our societal needs, a possible approach may involve understanding the underlying mental models rather than merely fine-tuning the outcomes. As suggested in Donella Meadows’ Thinking in Systems, intervening in the mental models within a system can have a significant impact. However, it is essential to bear in mind Albert Einstein’s warning mentioned on the Waters Center site: “To break a mental model is harder than splitting an atom.”

Mental models encompass personal beliefs, values, and perceptions that influence what we observe, how we interpret it, and the subsequent beliefs we form. Often hidden from our awareness, these mental models are frequently accepted without critical thought, making them challenging to change.

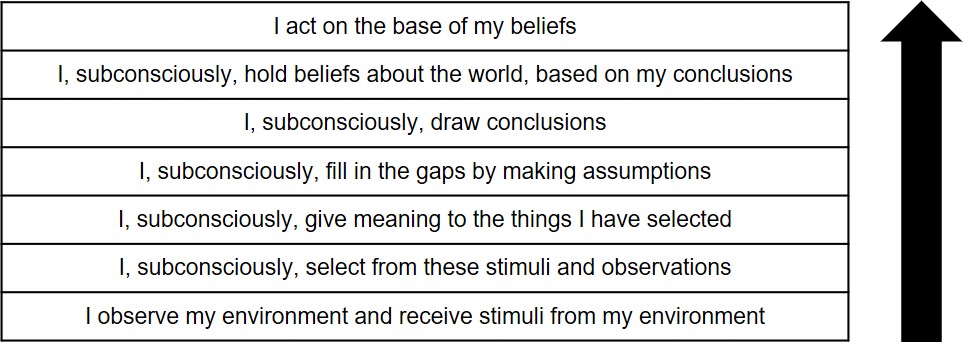

The ladder of inference was originally conceived by organizational psychologist Chris Argyris in 1990. The picture above is a simplified version. More conducive to our objective is the picture below:

Notably, most of the rungs on this ladder are ascended subconsciously, akin to Daniel Kahneman’s “Thinking, Fast and Slow.” To bring the underlying mental model to the surface, we must descend the ladder. Allow me to illustrate this with an example.

Suppose I have recently experienced prolonged periods of extreme heat, leading me to consider purchasing an air conditioning system. Let’s descend the ladder:

- Why did I take this action? I decided to buy air conditioning due to the extended periods of extreme heat. Additionally, since I have solar panels and the excess energy goes unused without reimbursement, I might as well use it for cooling.

- What belief led to that action? Firstly, I believe that climate change will lead to more and longer periods of extreme heat in the future. Secondly, I believe that the surplus energy I generate should be used to avoid wastage.

- How did I draw that conclusion, and is it sound? The first conclusion is based on climate change data recorded by my country’s meteorological institute, which seems like sound reasoning. However, the second conclusion is not entirely valid, as the unused energy is not wasted, but rather utilized by others. It prompts me to consider other beliefs, such as finding ways to store the excess energy for future use.

- What am I assuming, and why? I appear to assume that the meteorological institute is a reliable source for informing me about observed climate change. Additionally, I assume that I generate more energy than I can use during heatwaves, although this assumption might not be entirely valid since the electricity production of solar panels decreases above 25 degrees Celsius..

- Are my assumptions valid? I believe my assumption about climate change is valid. However, my assumption about the excess energy might be flawed. I must reevaluate this aspect with greater rigor.

By going through this process, I realize that my assessment of energy consumption may not be entirely rigorous. While the argument regarding climate change holds, I have also become aware of the environmental impact of air conditioning.

For instance, I recently learned that the cooling agents used in airconditioners, HFCs, are potent greenhouse gasses. HFCs used as cooling agents in car airconditioning systems, for example, have a greenhouse effect 1,300 times greater than CO2. HFCs are primarily released at the end of an airconditioner’s or refrigerator’s lifespan. As more airconditioners are installed, these appliances accumulate more HFCs, posing an additional risk for climate change. (Source: RIVM.nl)

Airconditioning also releases heat directly into the atmosphere. Similar to a fridge, it extracts heat from the inside of a building or car and transfers it to the outside. This extra heat contributes to hotter cities and raises night-time temperatures by up to 2°C, prompting people to increase their airconditioning usage even further. (Source: The Guardian, 2016)

However, I find myself wondering, “Does this information really matter to me?” My decisions are influenced by my observations of the environment, such as rising temperatures and prolonged periods of extreme heat, and the stimuli I experience when temperatures surpass 35 degrees Celsius. Based on these factors, I make my decision about purchasing airconditioning.

And here lies the essence of my point: each individual’s decisions collectively lead to market outcomes that we often categorize as ‘market failure.’ We tend to attribute such failures to ‘imperfect information. However, as evident from my somewhat self-centered perspective, having ‘perfect information’ might not change my decision to buy airconditioning. This is because the information does not directly impact me—I perceive that airconditioning lowers the temperature in my home—and the long-term consequences, such as climate change, seem distant since the average lifespan of an airconditioner is about 15-20 years.

This brought to mind a famous quote by Adam Smith: “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest. We address ourselves not to their humanity but to their self-love, and never talk to them of our own necessities, but of their advantages.” It is not altruism but rather self-interest that guides my decision to purchase airconditioning, reflecting a mental model that subconsciously sees this as the obvious choice.

Mental models serve as the most influential point for intervention. Yet, how can we intervene when a more thorough assessment of the data primarily implies long-term effects? How does this translate to our short-term-prone minds? More importantly, how can we intervene when we strongly believe that prioritizing self-interest will benefit society as a whole?

Engaging in discussions like these in the classroom can be an enriching experience, as it brings forth the significance of mental models and their influence on market outcomes, which may sometimes lead to what we label as ‘market failure.’ As Adam Smith aptly put it, individuals often act out of self-love rather than benevolence, and understanding these underlying mental models becomes a powerful tool for meaningful intervention in economic systems.

henny@21steconomics.org – You can also find me on LinkedIn

Ladder-image by Jazella from Pixabay

Airconditioning Image by Peggy und Marco Lachmann-Anke from Pixabay